Exactly How Home Equity Loan Can Finance Your Following Big Project

Exactly How Home Equity Loan Can Finance Your Following Big Project

Blog Article

Demystifying the Certification Refine for an Equity Loan Approval

Navigating the certification process for an equity funding approval can typically appear like understanding a complex puzzle, with numerous factors at play that establish one's eligibility. Comprehending the interplay between debt-to-income proportions, loan-to-value proportions, and other key standards is vital in securing authorization for an equity lending.

Trick Qualification Criteria

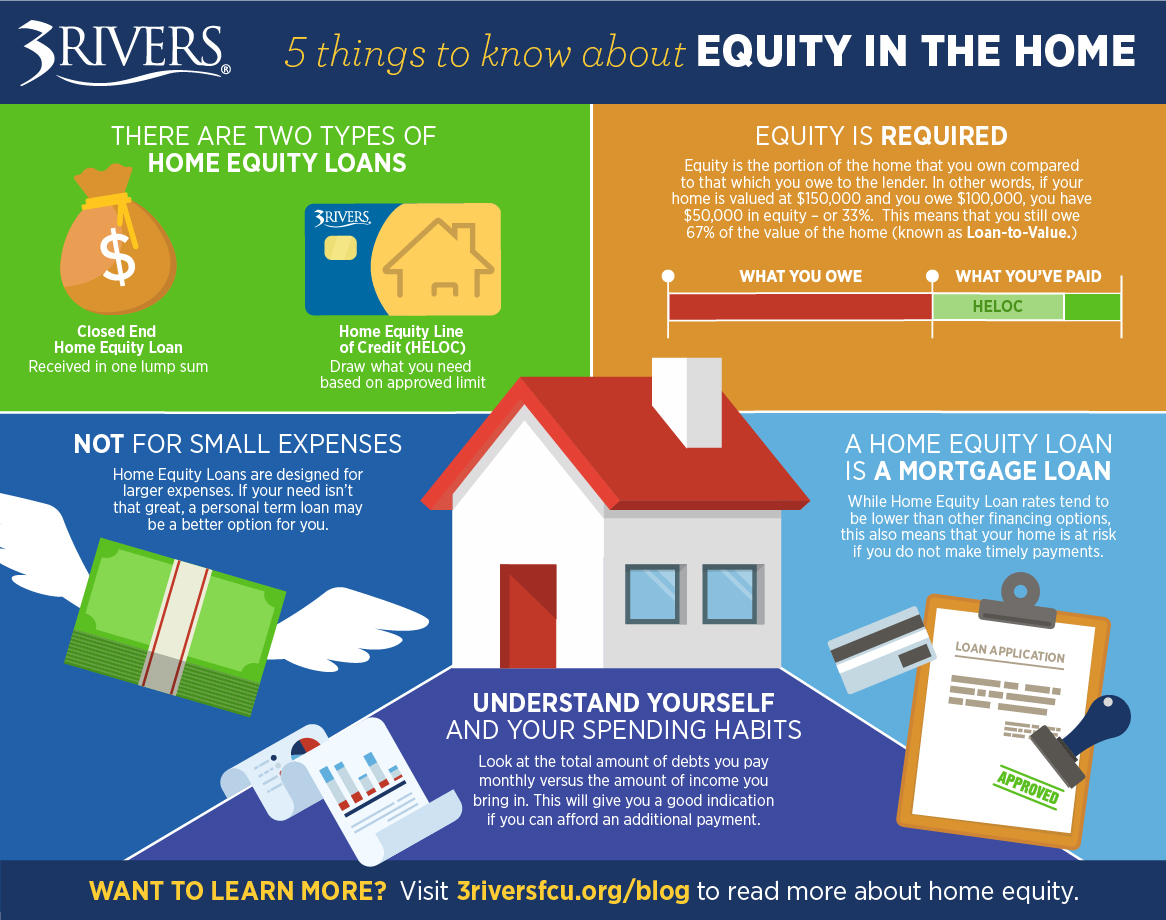

To receive an equity finance approval, conference particular crucial eligibility requirements is crucial. Lenders normally need applicants to have a minimal debt score, usually in the series of 620 to 700, depending upon the organization. A strong credit rating, showing a responsible payment record, is likewise important. In addition, lenders evaluate the applicant's debt-to-income proportion, with a lot of favoring a proportion listed below 43%. This shows the customer's capacity to manage extra debt properly.

Additionally, loan providers review the loan-to-value proportion, which contrasts the amount of the funding to the evaluated worth of the residential or commercial property. Meeting these crucial eligibility requirements enhances the chance of protecting approval for an equity lending.

Credit Report Value

Credit history usually vary from 300 to 850, with greater ratings being a lot more beneficial. Lenders commonly have minimal credit history rating requirements for equity financings, with ratings over 700 generally thought about good. It's important for applicants to assess their credit report reports frequently, examining for any type of mistakes that can negatively affect their scores. By preserving an excellent credit rating with prompt expense repayments, reduced credit use, and liable borrowing, candidates can enhance their chances of equity finance authorization at competitive prices. Understanding the importance of credit rating scores and taking steps to boost them can substantially influence a consumer's monetary chances.

:max_bytes(150000):strip_icc()/dotdash-home-equity-vs-heloc-final-866a2763fd0548eaa393afa0ffd7372b.jpg)

Debt-to-Income Proportion Analysis

Provided the important role of credit ratings in establishing equity finance authorization, another critical element that lending institutions analyze is an applicant's debt-to-income ratio analysis. A lower debt-to-income proportion indicates that a debtor has more income readily available to cover their financial obligation payments, making them an extra attractive candidate for an equity car loan.

Lenders normally have certain debt-to-income proportion requirements that consumers have to fulfill to certify for an equity financing. While these needs can differ among lending institutions, a common criteria is a debt-to-income ratio of 43% or lower. Customers with a higher debt-to-income ratio may face challenges in securing authorization for an equity loan, as it suggests a greater danger of failing on the car loan. Equity Loan. Consequently, it is vital for applicants to evaluate and potentially reduce their debt-to-income proportion prior to using for an equity lending to enhance their chances of authorization.

Residential Property Appraisal Needs

Examining the value of the building with a thorough evaluation is an essential action in the equity funding approval process. Lenders need a home assessment to guarantee that the home supplies adequate security for the lending quantity asked for by the debtor. During the property evaluation, an accredited appraiser evaluates different variables such as the residential or commercial property's condition, dimension, place, similar residential or commercial property worths in the location, and any type of distinct attributes that might affect its overall worth.

The home's assessment worth plays a crucial function in determining the optimum quantity of equity that can be obtained against the home. Lenders usually need that the evaluated worth meets or goes beyond a certain percent of the lending amount, known as the loan-to-value ratio. This proportion helps mitigate the loan provider's danger by making sure that the home holds enough worth to cover the lending in case of default.

Inevitably, an extensive property assessment is important for both the loan provider and the customer to precisely assess the residential property's worth and establish the feasibility of granting an equity lending. - Equity Loans

Recognizing Loan-to-Value Ratio

The loan-to-value proportion is a vital economic metric utilized by loan providers to analyze the threat related to supplying an equity loan based on the property's appraised value. This proportion is computed by separating the quantity of the financing by the appraised worth of the residential or commercial property. For example, if a residential or commercial property is assessed at $200,000 and the finance amount is $150,000, the loan-to-value ratio would certainly be 75% ($ 150,000/$ 200,000)

Lenders utilize the loan-to-value proportion to determine the level of risk they are taking on by offering a car loan. A higher loan-to-value proportion suggests a greater danger for the loan provider, as the debtor has much less equity in the building. Lenders normally prefer reduced loan-to-value ratios, as they supply a padding in case the borrower defaults on the residential or commercial property and the financing requires to be sold to recoup the funds.

Consumers can likewise take advantage of a reduced loan-to-value ratio, as it may lead to better funding terms, such as reduced rate of interest rates or decreased fees (Alpine Credits Home Equity Loans). Understanding the loan-to-value ratio is crucial for both lending institutions and consumers in the equity lending approval process

Final Thought

In verdict, the qualification process for an equity lending approval is based on vital qualification criteria, credit score relevance, debt-to-income proportion analysis, residential property appraisal needs, and recognizing loan-to-value ratio. Satisfying these standards is essential for protecting approval for an equity car loan. It is vital for customers to carefully assess their financial standing and property worth to enhance their chances of approval. Understanding these variables can help people navigate the equity car loan approval process a lot more effectively.

Understanding the interaction in between debt-to-income ratios, loan-to-value ratios, and various other vital criteria is paramount in safeguarding approval for an equity financing.Provided the crucial function of credit history content ratings in establishing equity funding approval, an additional vital element that lenders analyze is a candidate's debt-to-income proportion evaluation - Alpine Credits copyright. Consumers with a higher debt-to-income proportion might encounter difficulties in securing authorization for an equity finance, as it suggests a greater threat of failing on the loan. It is crucial for applicants to examine and possibly minimize their debt-to-income ratio before applying for an equity funding to enhance their chances of authorization

In final thought, the qualification process for an equity loan authorization is based on vital qualification standards, debt score significance, debt-to-income proportion analysis, home evaluation needs, and understanding loan-to-value ratio.

Report this page